Founders, Looking for VC Funding? Avoid These Common Pitfalls

As an early-stage startup, there are few moments more exciting than securing funding to help you grow.

Most founders see funding as validation for their idea and in a way, a guarantee that success is on the horizon.

After recently becoming an LP at Stage 2 Capital, there fire in my belly burns brighter to help our startup ecosystem be the best it can be.

I come with peace and love to caution you to pump the brakes. Why? Because I’ve seen far too many founders lose control and get sucked into the “growth at any cost” hamster wheel once they get VC funding.

Funding does NOT always equal success. Especially if you haven’t fully validated your product or service in the market.

Some of the common traps that founders fall into are:

- This is their first rodeo and don’t have the perspective to know how venture capital works or what good funding looks like for their startup

- Anti-dilution rights

- Founder vesting schedule

- Liquidation preferences

- Lack of alignment with the investor

- They’re intimidated or don’t know what questions to ask throughout the funding process

- They give up too much control and become beholden to the VCs over the needs and values of the company

- They assign the wrong people board seats and succumb into poor advice and guidance

- They turn the reins over the wrong executive team, steering the whole strategy off course

- Unrealistic expectations. The odds of becoming a “Unicorn” are about 1%.

Case in point: I know a company that recently got $10M in funding from a venture partner who’s notorious for having a growth-at-any-cost mindset.

The company was bootstrapped and profitable. Within three months of securing their A-Round, everything changed… for the worse. The lead investor’s mindset of unrealistic growth and aggressive hiring milestones to put as many rear ends in seats created churn within their customer base (98% retention to 63%) and a paper trail of expensive mishiring including two executive sales leaders. All to chase money that wasn’t theirs to chase yet.

It’s critical to stay clear, curious, and intentional before, during and after funding.

There’s a big difference between growth, profitable/sustainable growth, and growth at any cost.

I’ve lost track of all of the incredible products out there that ended up in the graveyard due to flawed GTM strategies driven by the wrong venture partners.

Don’t get me wrong, VC funding is important and there are some outstanding options in the marketplace. However the health of your business is dependent upon how you pitch, who you sign a deal with, and what you do with the money after.

What to do before you secure funding

It’s time to get your ducks in a row. VC funding has never hurt a startup that was prepared to receive it with proper plans in place to execute results from there.

Before the pitch, take a step back and make sure your startup is ready to move forward. Brace yourself, things move fast once the money is in the bank. And remember what Greg Head preaches:

“You inherit the business model of your biggest investors.”

Get clear and intentional with things like:

- As Simon Sinek says, it starts with why. Why do you need this money?

- What are your goals for the investment?

- Are you setup a Delaware C Corporation?

- Have you established a product-market fit so it’s clear you won’t be throwing money at something that doesn’t have any traction?

- Have you developed a pricing strategy that ensures you aren’t going to market with an unachievable revenue model?

- Do you know how to consider a term sheet?

- Do you have a good lawyer that specializes in startups at your stage?

Most founders get funding and dive headfirst into a big hiring spree without understanding what they need to hire for, who they need to hire, and what a good hire looks like for their business.

For example, when it comes to sales leaders, these are 3 common bait-and-switches:

- The company misrepresented their product-market fit in interviews. Founders, this is a problem for you to solve before you spin up a sales team. You can’t scale what you don’t have.

- The company misrepresented their numbers. People don’t expect perfection, but they do expect honesty.

- The sales leader was promised a seat at the table and a lot of upside only to be left hanging with a one-way ticket to nowhere.

Turning over a sales leader at this critical growth stage holds a startup back versus propelling it forward and can have devastating consequences.

Top Reasons Startups Fail

Also, the funding process itself is quite complex. There are many factors and nuances to consider. Don’t jump into pitching before you know exactly what you’re getting yourself into.

No VC is going to invest in your company without a clear incentive to do so. They’re looking for ROI through the competitive differentiation and advantage your startup has in the market. Simply put, are you a vitamin or a painkiller?

I’m particularly close with a well known VC and speak with them a lot. They won’t touch a company that doesn’t have 200%+ YoY growth. Contrast that with a Founder I know well and his startup was just passed up by 15 “suitors” because they’re dealing with a big customer churn problem.

If you’re going to get money from a reputable investment partner, your backyard has to be in order.

Some of the key conditions that reputable VC’s are looking for:

- Do you have a strong product with a clearly established product-market fit?

- Can you demonstrate that your startup is poised for rapid, expansive growth over the short, near, and long term?

- What is the quality of your management team?

- What is your true valuation?

- Does your unit economics make sense?

These details need to be ironed out before you start your search. Otherwise, your chances of cashing those big checks dramatically decrease.

Finding the right funding partners

Not all money is created equal. It’s imperative to select your investment partners wisely. That means understanding what good looks like for your startup, having tough conversations upfront, and setting expectations together early and often.

Take a step back and remember what investors are here to do and that there are many flavors of investment in the market. It’s critical to understand as much as you can about their investment strategy BEFORE signing anything.

Each investor meeting should be a shared process of deep discovery that establishes expectations and confirms or denies all the details together.

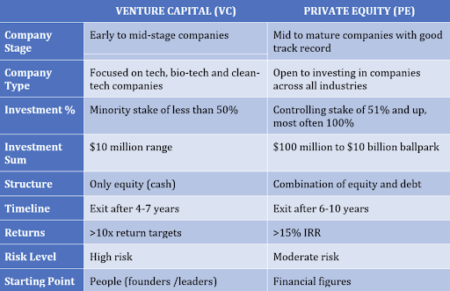

There are lots of ways to get money. The most common methods are private equity and venture capital, which each have their benefits and drawbacks:

Most Common Methods are Private Equity and Venture Capital

Source: https://www.theseacapital.com/blog/private-equity-vs-venture-capital-whats-the-difference/

Whichever method you decide to pursue, make sure that you’re aligned on all the important details.

Stay clear-headed once you get funding

Once you get funding, the pace can pick up fast and it’s easy to get lost in the whirlwind of it all. This is where you need to stay clear on your path forward and the goals laid out by both sides in the negotiation process. Everyone involved needs to stick to their side of the agreement. And if things change, work through those changes together.

Key factors to pay close attention to:

- Does your VC have an operating team to help you grow?

- Do you have the right sales leader in place (in case you need help pinpointing the details, this replay of my LinkedIn Live with Pablo Dominguez from Insight Partners breaks it down for you)?

- Do you know what your segments are and what the buyer journey looks like in all those segments?

The more you know, the better you’ll be able to put that funding to good work while growing your business at the same time.

Before you jump into a hiring bonanza without getting clear on exactly where you want to go and what you need to get there.

The best founders lean into transparency throughout the hiring process versus getting caught up in selling the dream.

It’s simple: Alignment = Retention = Growth

If you’re unable to do this, it’ll bite you down the line and is one of the key factors while sales turnover rates are out of hand in startups.

Slowing down to go fast later is a superpower. Take the time to develop a bulletproof hiring process and get clear on why, what, who, and how.

Use a hiring scorecard to stay on target while checking your emotions to make well-informed hiring decisions. No, your gut isn’t the be-all and end-all part of the decision making process and it certainly isn’t scalable.

Giving too much weight to the input of your VC’s – who are purely focused on ROI – can lead to you forgetting what got you here in the first place.

A repeated issue I see with founders is that they’ll hire a top sales leader, that leader will have a KILLER year that exceeds their targets, and the founder will move the goalposts WAY higher to avoid paying out big checks.

Incredible results deserve incredible rewards. If you expect someone to help you build a rocketship and stick around to keep building it, pay them. Do you like it when you don’t get paid? I didn’t think so… Messing with compensation plans because your sales team is succeeding is missing the long-term picture.

It’s one thing to have stretch goals, it’s a whole other ball of wax to take away hard-earned rewards. Do this and you’re going to have a subpar team that will be looking for opportunities elsewhere.

At the same time, what got you here may not get you to the next milestone. Adapting your plan to keep up with the demands of the business and market is important.

For example, maybe you’ve been in SMB, got funding, and are now considering a shift into the enterprise market.

- Do you understand what that takes before pouring funding into it?

- New enterprise reps will take at least 12 months to get up to speed. Do you and the VC realize that and have the runway to do it?

If you get in over your head with enterprise sales, you run the risk of burning through that VC funding quickly, losing the trust of your VC, turning over your team, botching up relationships with big brands where you won’t be able to get back in, and ending up in a worse position than you were before.

Wrapping Up

Securing funding is exciting as an early-stage startup founder, but it’s just the beginning of the journey. Before you make a big push for funding, take the time to get all the details straight.

That’s the only way you’ll end up with an investment partner that’ll support your startup’s growth well into the future.

And above all, make sure you’re well-aligned with whoever you sign a deal with. Otherwise you could get roped into chasing unrealistic numbers, losing sight of your values, and leading your startup down a slippery slope.

Long game > Short game for the win.